(Click image below)—View & interact with the ISAAC KAPPY MIND MAP—(Click image below)

Predictit

Isaac made it very clear in his last periscope that he had made a decision in the “blink of an eye” that changed everything. He stated that this was his great betrayal. The sediments are also echoed in the last letter he posted to his Instagram. What’s more, I have it on first-hand account that he told a friend that he had been gambling his last week in an attempt to generate more money so that he could move from Michelle’s house, as he hated living there. The predictit withdrawal on his bank statement most certainly matches up with the timeframe that Isaac himself stated he was gambling and made his great betrayal.

PredictIt is a New Zealand-based prediction market that offers prediction exchanges on political and financial events. PredictIt is owned and operated by Victoria University of Wellington with support from Aristotle, Inc. The market was launched on 3 November 2014. PredictIt’s office is located in Washington, D.C. PredictIt was launched on 3 November 2014. By March 2016, the website had approximately 29,000 active traders.

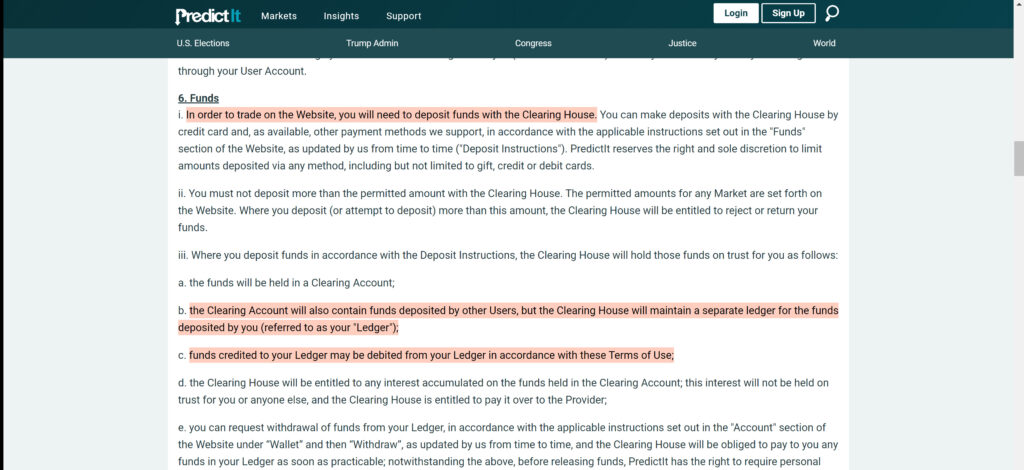

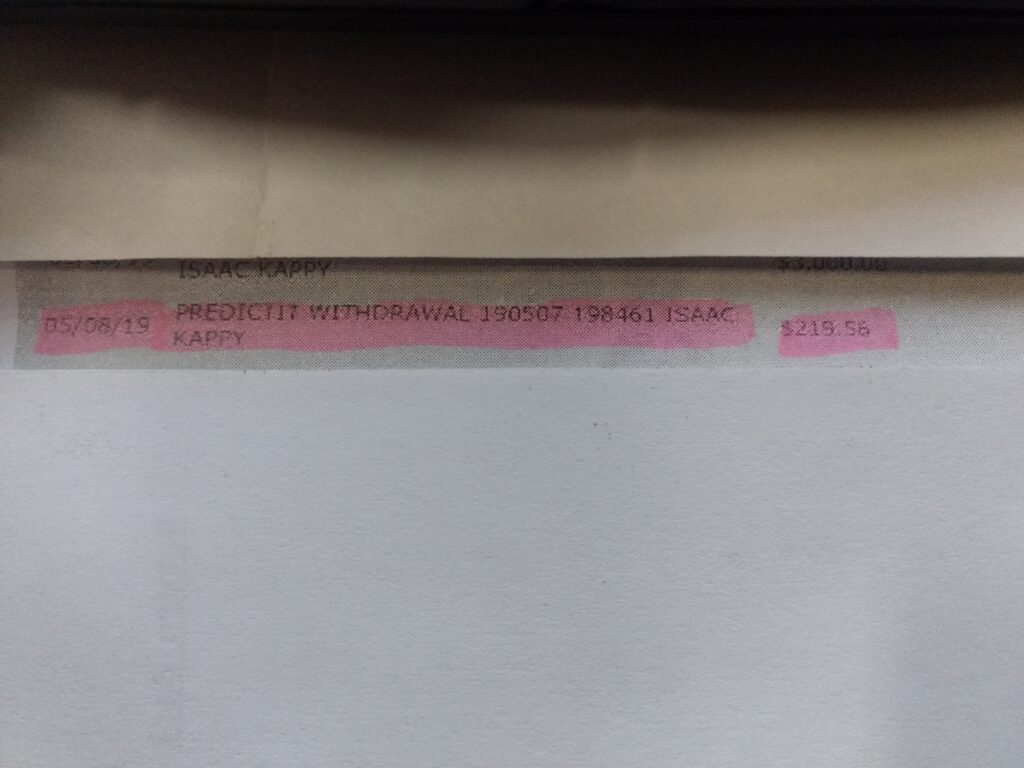

Image of a Predictit withdrawal from Isaac’s bank statement.

Kappy and predictit

You can see from the above photo that Kappy had a withdrawal from his predicted account of $215.56. There’s no doubt that Isaac Kappy was indeed trading on the predictions market known as predictit based out of New Zealand. And minus a court subpoena requesting the ledgers from this company the world may never know.

Isaac Kappy also had numerous withdrawals the last couple months of his life from Robin Hood including February 25, 2019, for $100 / March 8, 2019, for $20 / April 18, 2019, $179.03. Isaac was obviously involved in speculation prior to the predictit withdrawal post $219.56 on May 8.

It appears from the last few months of his bank statements that Isaac only had one exchange with the predictit market, and that was on May 8. That being said he would’ve had to open an account at one point in order to have a ledger with the market. I can’t fail to notice the correlation between Isaac’s trip to Australia and his involvement with a New Zealand-based company that gambles on political outcomes. It’s my opinion, this is only an opinion until more evidence surfaces that He became involved with predictit there.

Isaac had gone to Australia to meet with his then-friend Ella high priest. The trip started out well enough but by the end, he was calling his closest friends in the states saying he just wanted to get back home. He had a falling out with Fiona Barnett and Ella high priest while over there. Although he was very private about the details of what transpired exactly.

Now here’s what most people don’t know. Isaac had proprietary information on pedophiles and suspected pedophile rings in and surrounding Washington DC. He was preparing to make a second run at outing these people. I believe it is quite possible that someone convinced him to use this information as leverage in the predictive markets in order to generate political outcomes which would be financially profitable. All it would take is the foreknowledge of what information would be leaked and someone to leak the information to the proper recipients who would run it up and into the mainstream media. I believe Isaac had met that person when he reached Australia.

I believe this could have been what he considered his great betrayal.

How it works

PredictIt uses a continuous double auction to sell shares for each event in its markets, meaning that for every person who predicts that an event will take place, there must be another person who predicts that it will not. The site groups related predictions into a market.

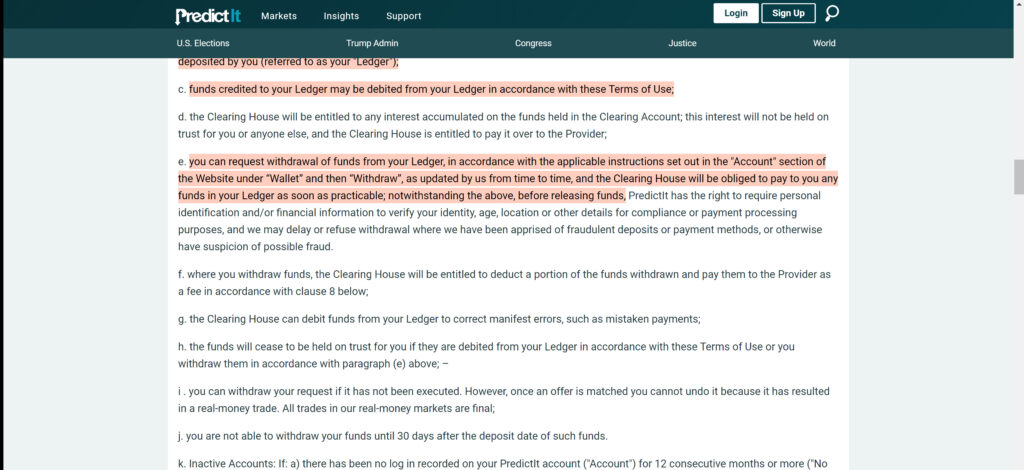

PredictIt’s operating expenses are covered by charging a fee of 10% on earnings in excess of the original investment and by charging an additional 5% withdrawal fee.

Rules and limits

Victoria University of Wellington secured a no-action letter from the Commodity Futures Trading Commission, eliminating the risk of prosecution for illegal online gambling. In order to secure the no-action letter, each question is limited to 5,000 traders, and there is an $850 cap on individual investments per question. These restrictions are modeled after the Iowa Electronic Markets, which previously secured a no-action letter from the Commodity Futures Trading Commission; however, there are differences in the restrictions between the two markets.

Withdrawals